Credit Risk of Financial Vehicle for Energy Retrofits of Buildings (RENOWAVE 3.1)

D | Marcus DrometerLecturer University of Applied Sciences Lucerne |

Abstract

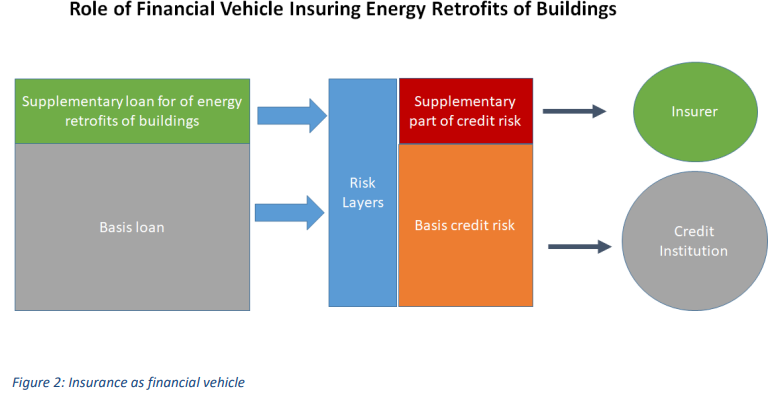

Cost of capital represents an important component of the mortgage rate. The impact of risk sharing approach depends on the benefits of credit institutions and the price of shared risk. The aim of this paper is to prove that the required capital of an insuring vehicle is low enough to allow acceptable insurance premium that might accelerate noteworthy market demand for sustainable renovations/investments of real estates. For this purpose, we will define model points representing risk classes and measure the required capital based on major risk metrics and compare them with the existing standard regulations in absence of the suggested regulation.

Authors: Drometer, Marcus et al.

Type

Applies to

| HSLU - IBR Institut für Betriebs- und Regionalökonomie Luzern |